How to Submit Your Tax Information?

Easy Guide to eBay Partner Network Tax Forms 📝

What's New?

Starting September 5th, 2023, if you're a non-U.S. eBay Partner Network (ePN) member, you'll need to update your W8 form every three years. If you haven't uploaded or updated your W8 form recently, now's the time to do it!

How Will You Know When to Update?

You'll receive an email and see a pop-up in your ePN dashboard when it's time to update your tax information. For example, if your last W8 update was before 2021, make sure to resubmit it before January 1st, 2024.

Important Things to Remember

- Match Your Info: Make sure the name, address, and bank details on your tax form match your ePN account.

- VAT Details: ePN is a U.S. company, so VAT doesn’t apply to your earnings, even if you live in Europe.

- Taxes Are Your Responsibility: Any taxes due in your country or state are your responsibility to pay.

Types of Forms

- W9: For U.S. residents (individuals or businesses). No expiration.

- W8-BEN: For individuals outside the U.S.

- W8-BEN-E: For companies outside the U.S.

- Other Types: Depending on your scenario, you may need to use one of the other forms. Please consult a tax professional if you are unsure.

Form Expiry

W8 forms expire at the end of the third year. For example:

- Submitted on May 1, 2023: Valid until Dec 31, 2026.

- Submitted on Dec 31, 2024: Valid until Dec 31, 2027.

- Submitted on Jan 1, 2025: Valid until Dec 31, 2028.

Stay Updated

Six months before your form expires, you'll get reminders in your ePN dashboard and email. Once you submit a new tax form, the validation process can take up to 48 hours. Check your ePN dashboard to confirm there are no errors.

How to Submit Your Tax Form

- Log In: Go to your ePN account.

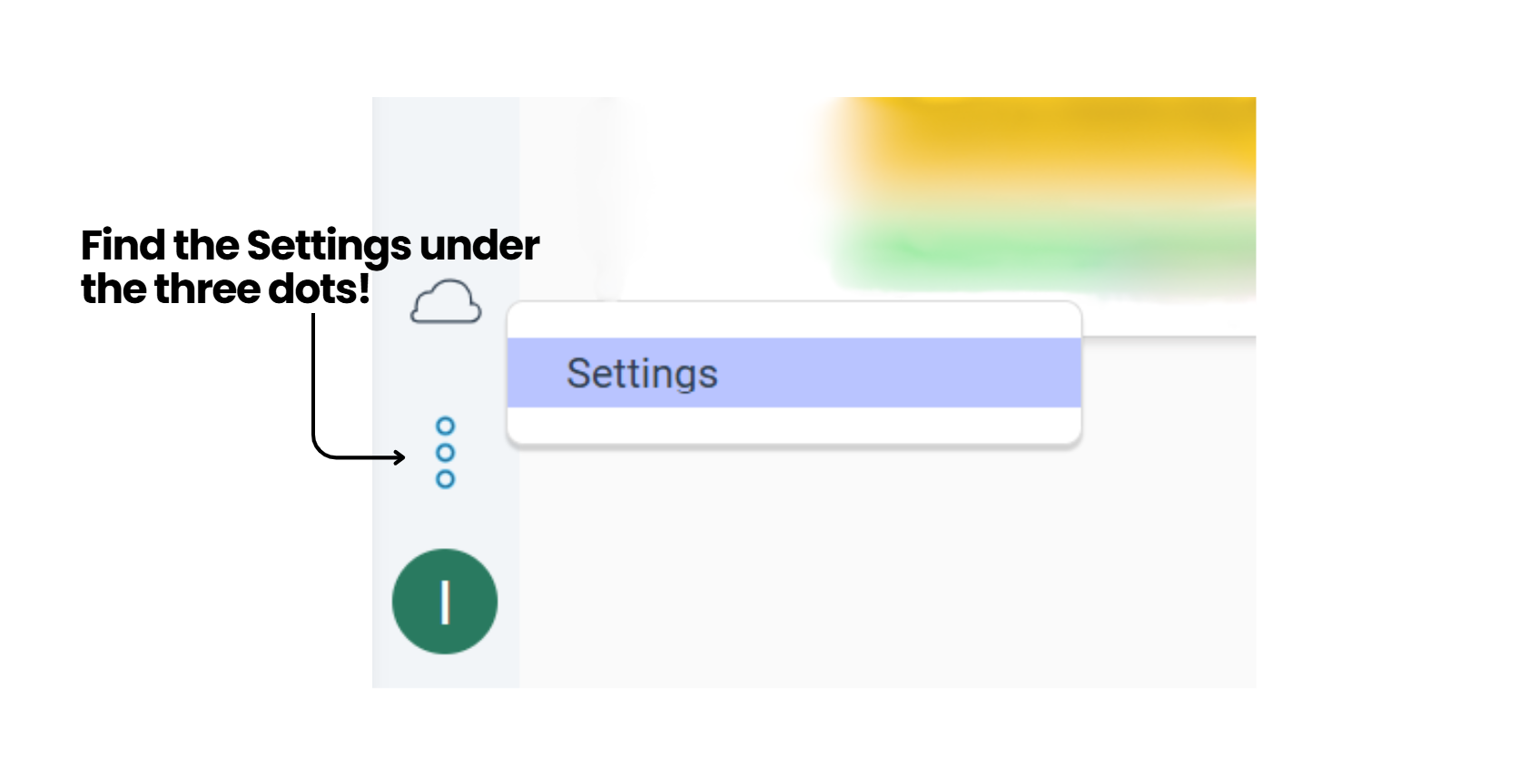

- Access Settings: Click the three dots on the left menu.

- Select Tax Documents: Find this option in the menu.

- Fill in Your Info: Enter your tax details and click 'Continue.'

- Security Setup: Copy your security code and set a security question.

- Choose Your Form: Select the form that fits your situation.

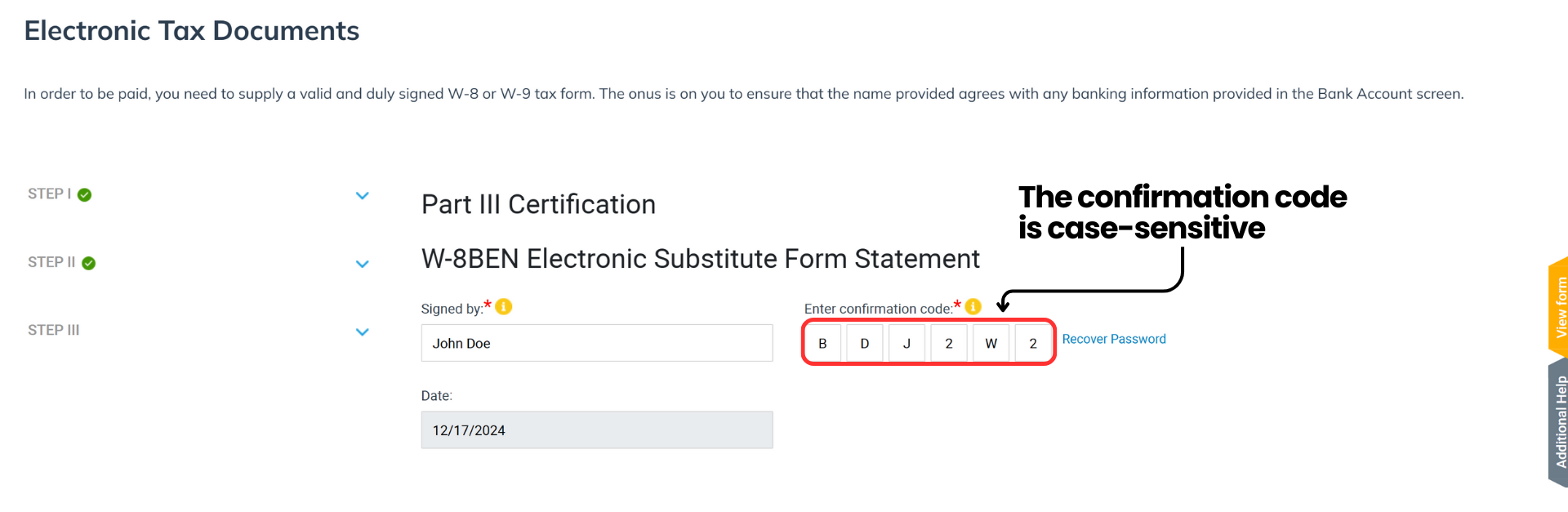

- Submit: Enter the confirmation code, sign it, and submit.

We recommend you talking to a local tax professional or visit IRS.gov if you have any questions.